Oculus Echo - Mean Reversion

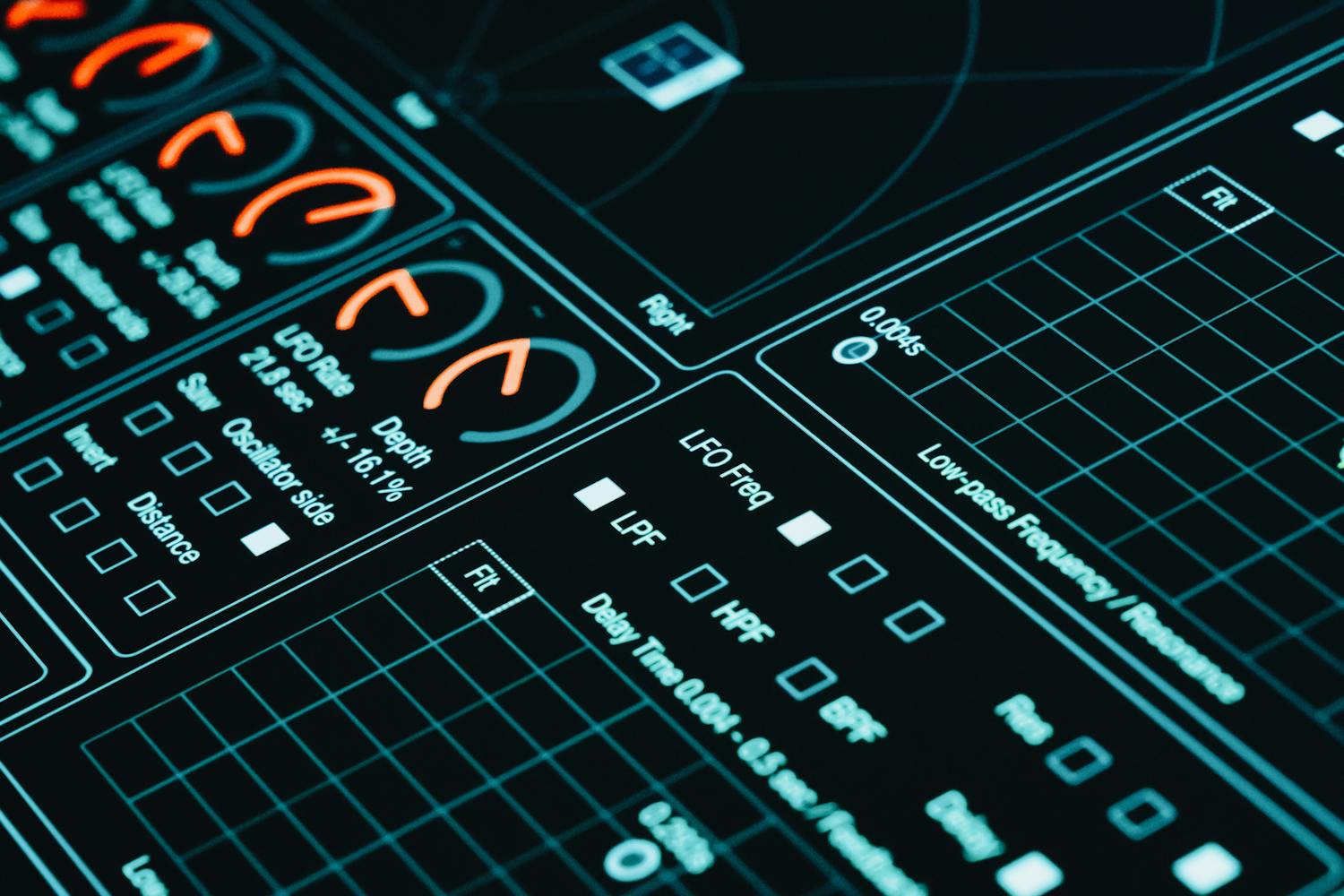

Echo is our FX mean-reversion engine, designed to capture snapbacks after short-term dislocations in liquid currency pairs. It targets moments where price overshoots due to flow, positioning, or liquidity imbalances—then waits for confirmation before engaging.

Echo doesn’t trade everything: it applies volatility + regime filters to avoid low-quality conditions and overtrading. Inside the portfolio, Echo acts as the “stability” sleeve—more active in rotational markets, while stepping back when trend conditions dominate.

Key focus: filtered FX reversion, controlled risk, systematic execution.